Forex Trading Tutorials

Fibonacci Numbers

Fibonacci numbers is a set of numbers 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, and so on. This sequence was named after Leonardo Fibonacci (1175-1250) who was a great mathematician from Italy. Fibonacci introduced this series and its significance to the western world in the 12th Century. However, the series was also analyzed sometimes during 5th and 6th centuries by the Indian Mathematicians and Philosophers.

What is this Fibonacci Series?

Fibonacci series is a geometric series where the first number is 0(zero), second number is 1(one) and then each subsequent number is the sum of previous two numbers. Based on this principle, if you wish to derive Fibonacci series then it works out as: 0, 1, 1(0+1), 2(1+1), 3(1+2), 5(2+3), 8(3+5), 13(5+8), 21(8+13), 34(13+21), 55(21+34), 89(34+55), 144(55+89).

What is the significance of Fibonacci Series?

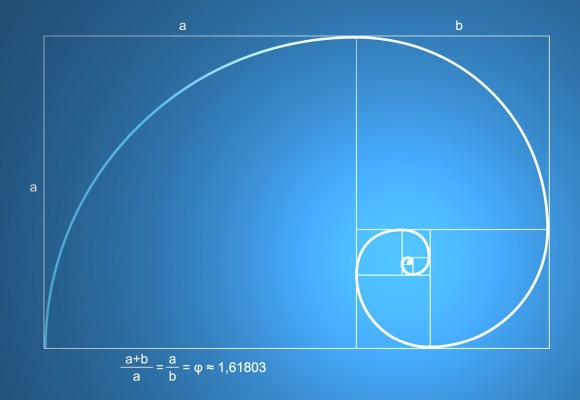

Fibonacci series is full of many remarkable properties. As you proceed in the series, the ratio of any number with the number following it is 0.618. Alternatively, each number is 1.618 times the preceding number. Let us see how this appears. (1) 13/21 = 0.619, 21/34 = 0.618, 34/55 = 0.618, 55/89 = 0.618 (2) 21/13 = 1.615, 34/21 = 1.619, 55/34 = 1.618, 89/55 = 1.618. If you continue further then you will find that this ratio 0.618 and alternatively the multiple 1.618 remain constant till infinity. This ratio 0.618 is popularly termed as golden ratio. In addition to the golden ratio, there are many more inter-relations between the numbers and the ratios.

The real significance of Fibonacci lies in how the co-relations between the series and the ratios create wonders. Over the centuries people have widely used these excellent properties of Fibonacci series. Fibonacci series works in a very interesting manner in the different theories, models, and analysis. Magic of Fibonacci numbers is prevalent even in the universe and the nature around you. Leave patterns in certain plants, rings of Saturn, pine cone, honeybees, and breeding of rabbits and whorls of sunflower.

What are the applications of Fibonacci Numbers?

Fibonacci series has been applied in numerous mathematical and scientific studies. Many theorems of math and science have evolved on the basis of Fibonacci numbers which have further led to new discoveries. Fibonacci numbers have also penetrated in technical analysis applied to the financial markets. Participants in stock markets and forex markets extensively use Fibonacci numbers for trading algorithms and strategies.

Fibonacci Numbers in Technical Analysis

Golden ratio of 0.618 is the most important number for technical analysts. In addition to 0.618, 0.382 and 0.5 are two other ratios of Fibonacci series that are considered as powerful figures in the technical analysis. Fibonacci numbers and ratios are commonly used in the technical analysis to decide support and resistance levels. Traders use these ratios to ascertain the retracement levels. Based on the retracement levels and the trends, the traders initiate their buy or sell trades. Fibonacci ratios are also sometimes used to find out the likely period when a top or bottom may be formed.

Summing Up

Present day forex trading platforms carry out most of the manual work related to Fibonacci numbers. The art lies in thoroughly understanding the significance of Fibonacci numbers and its application in the technical analysis to decide the trading strategies and to determine the price objectives.